When you think about a career in finance, does your mind immediately jump to complex equations and endless numbers? It's a common perception, but the truth about finance might surprise you. Whether you're a university student considering finance as a major or just curious about the field, understanding the real role of math in finance can help you make informed decisions about your future career path. Let's break down the myths and look at the reality of math in various areas of finance.

The Role of Math in Finance

Finance certainly involves math, but the level and complexity depend greatly on the specific area of finance you're interested in. From basic arithmetic to advanced calculus, the range of mathematical requirements can vary widely.

Areas Where Math Is Heavily Involved:

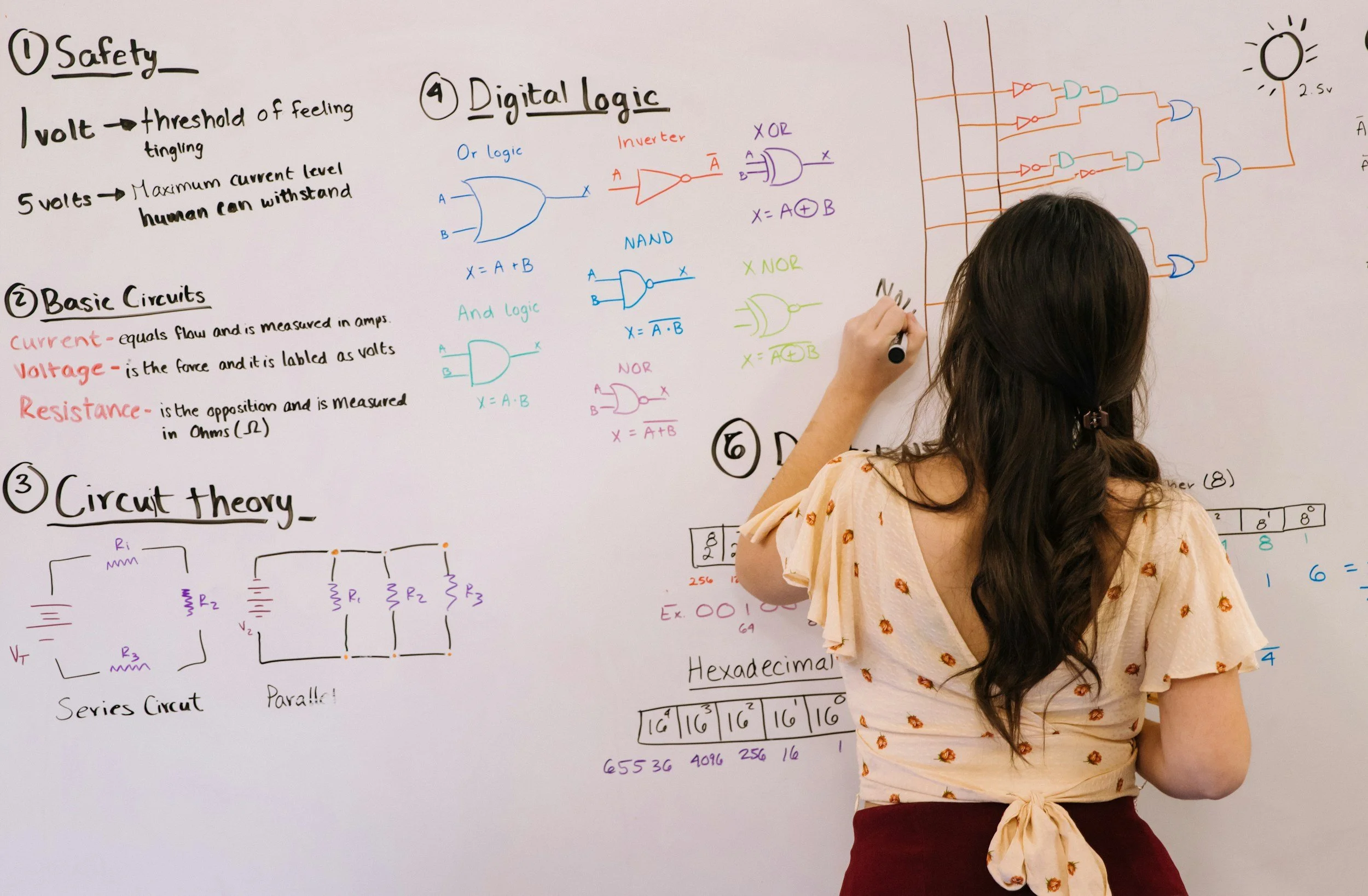

Quantitative Analysis: Often referred to as "quant" roles, these positions are math-intensive. Quants use complex mathematical models to predict market trends and develop financial products. Skills in calculus, statistics, and programming are crucial here.

Risk Management: This area involves assessing and managing the risks taken by a bank or investment firm. Professionals use statistical methods to predict and mitigate potential losses from investments.

Actuarial Science: Actuaries use math, statistics, and financial theory to study uncertain future events, especially those of concern to insurance and pension programs. This field requires a deep understanding of mathematics and statistics.

The finance industry is in fact rich with diverse roles that require a variety of skills beyond just mathematics. Finance companies need marketers, lawyers, business development managers, IT and a range of other skill sets - not necessarily just math based skill sets. Moreover, success in finance often hinges not just on your ability to crunch numbers but equally on building strong, trustworthy relationships. Here are a couple of areas in finance that are less math dependent:

Areas Less Dependent on Advanced Math:

Financial Planning: While it does require a good grasp of numbers, financial planning focuses more on helping individuals manage their personal finances and meet long-term goals. The math involved typically revolves around basic arithmetic and algebra.

Corporate Finance: Those who work in corporate finance deal with budgeting, forecasting, and funding activities within a company. While financial metrics and models are used, the mathematics is not as intense as in quantitative roles.

Investment Banking: While investment bankers do need to understand numbers and financial statements, the role is less about complex mathematics and more about negotiation, understanding markets, strategic thinking, and client management.

Client Relationship Manager

Client relationship managers play a crucial role in maintaining the financial health of a business by managing client accounts and building strong, long-lasting relationships with clients. This role requires excellent communication skills, empathy, and an understanding of client needs more than it does complex math.

5. Financial Advisor

While financial advisors need a good grasp of numbers, their primary role is to counsel clients on financial options in accordance with their long-term goals. Skills in communication, understanding client needs, and trust-building are paramount.

6. Compliance Officer

Compliance officers ensure that financial institutions adhere to all laws and regulations applicable to their business. This role requires a strong understanding of legal and regulatory frameworks, attention to detail, and ethical integrity.

7. Human Resources in Finance

Every finance company needs a robust HR department to manage hiring, training, employee relations, and compensation. People skills, communication, and organizational abilities are key in this role.

8. Marketing and Public Relations

Marketing professionals in finance help build brands, communicate product benefits to consumers, and develop strategies to reach new clients. Creativity, strategic thinking, and communication are more critical here than mathematical skills.

Dispelling the Myths

Myth 1: You need to be a math genius to succeed in finance. While strong quantitative skills can give you an edge in certain areas, many finance roles require more of a balance between math abilities and other skills like communication, negotiation, and strategic thinking.

Myth 2: All finance jobs are math-heavy. As outlined above, while some areas in finance are math-intensive, others rely more heavily on analytical and soft skills. Understanding the specific requirements of different finance roles can help you align your career with your strengths and interests.

Myth 3: More math always equals more money. While quantitative roles can be lucrative, other factors such as industry changes, demand for specific roles, and geographic location also significantly affect compensation.

Conclusion

For university students eyeing a career in finance, it's essential to evaluate not only your mathematical aptitude but also your interest in other aspects of finance such as market trends, corporate strategy, and client relations. Finance is a diverse field offering opportunities for both math enthusiasts and those who excel in other areas. By understanding the real role of math in finance, you can better navigate your educational path and career planning, ensuring a fit that is both satisfying and well-suited to your skills.

Remember, a successful career in finance is not solely determined by your ability to crunch numbers but also by your analytical thinking, problem-solving abilities, and interpersonal skills. While it’s definitely worth while to try your best at and make sure to study, it’s not the be all and end all if you’re not the best at math. There are plenty of non based roles in the world of finance that can give you an opportunity to excel!